Author Natasha Munson wrote “Money, like emotions, is something you must control to keep your life on the right track.”

How you manage your financial profile has a direct impact on many areas of your life. Ask yourself the following questions:

- How is your credit report these days?

- What interest rate does your savings account provide you?

- What types of fees are you paying for your checking account?

If these questions sound like a pop quiz, rather than a basic examination of your easiest-to-use financial tools, it’s time for a review. Use the following tips to review some of the most valuable and easily accessible financial tools at your disposal to help save money and free up more of your time.

Your Checking Account

Your checking account is the "home base" of your financial portfolio. It's where your income is deposited to fund savings and retirement accounts and pay bills. In order to optimize your checking account's quality, ask some basic questions, such as:

* Can you arrange for direct deposit?

* What kinds of fees and minimum balance requirements apply to your checking account?

If your employer offers direct deposit, take advantage of this feature to enjoy the benefits of automated banking. Do the same for social security, pension and dividend checks. Keep in mind that most banks offer “free checking” if you have direct deposit or other accounts with them.

Call your bank’s customer service department directly or pop into your local branch, and ask how you can avoid fees on your checking and other accounts. While you’re at it, ask about a “free” safe deposit box. This is called “relationship banking.” Also ask how minimum balance requirements apply to your checking account.

(Note: Run a similar test for your savings account. Also, make sure you inquire about the current interest rates on your savings accounts and compare them to other banks, including virtual banks.)

Sign up for online banking – it saves time, money, and makes it easy to manage your accounts with a couple of clicks. Financial institutions offer online access, as well as free mobile apps, which enable you to check balances, pay bills, transfer funds and make check deposits from anywhere in the world.

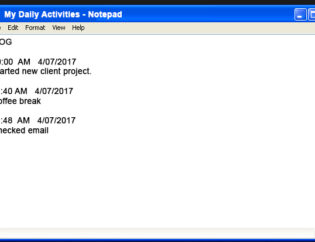

Manage your spending by using personal finance software or apps such as Quicken, Mint or Billguard to create a budget and track transactions when you connect online with your bank. Quicken’s slogan is Organize Your Money – Simplify Your Life. It’s easy to understand what that means once you see all of your accounts and spending habits in one place and can make sound financial judgment about your family’s personal finances.

Your Credit Cards

Credit cards can invite disaster if not used correctly. They're essentially small "loan" cards, similar to micro-loans, you use to pay for goods, services, bills and even vacations. If you use them correctly, credit cards can be invaluable. Here is the best part about them - you can leverage your credit cards to accrue frequent flyer miles, bonus cash, store rewards and other perks. But use them incorrectly, and you’ll find yourself spiraling into debt.

Call your credit card company, and ask about your APR (your interest rate) and late fees. You might even be able to negotiate a lower APR to help pay off your credit card debt. For tips on managing your credit cards, click here.

Your Credit Report

Maintaining good credit allows you to secure better rates on a mortgage, automobile and personal loans as well as insurance. You could save thousands, even tens of thousands of dollars, in finance charges and mortgage interest by maintaining a good credit rating.

Some employers run credit reports before they hire a new employee, so your credit report could have a direct impact on your earning potential. It is surprising to see the countless ways your credit report can impact so many aspects of your life.

Protect and monitor your credit rating by logging on and checking your financial transactions daily. Sign up for alerts and notifications from your financial institutions. Take advantage of the free annual credit report offered by each of the three credit agencies, TransUnion, Equifax and Experian. Check the reports at least once a year to make sure you're on track for a healthy credit rating and credit score. More importantly, check to see if you are a victim of identity theft.

Be wary of websites that sell services to access your credit rating and credit score. These businesses initially offer a free credit report service, but it comes with a hidden cost. The trick to avoiding these hidden fees is to stay focused when you log on to claim your free annual credit report. Do not sign up for any other service or offer, not even a “free” trial. If you are interested in your credit scores, Credit Karma offers a free service. Financial institutions, such as American Express and the big banks, also offer free credit scores.

Setting Yourself Up for Financial Success

Even though all of these actions might seem trivial or unimportant, taking small steps now can have a big impact on your financial future. Once you have a clear picture of your financial life at all times, you’ll be able to maximize the money you have and minimize the amount of debt interest you are paying.

I never knew that there were free checking options for those that have direct deposit accounts with them. My fiance and I are looking to join our accounts when we are married and we want to know how the funds would be transferred. Thanks for giving us a little bit more information on how to manage our finances.